In March, the Liv-ex Fine Wine 100 index rose 0.2% to 416.07, marking cautious growth after a four-month decline. The Liv-ex Fine Wine 50 fell by 0.2%, while the Liv-ex Fine Wine 1000 remained flat. This modest growth signals a slow recovery in the secondary market.

LONDON – The Liv-ex Fine Wine 100’s minor fluctuations reflect the industry’s risk aversion amid Q1’s financial and political instability. The index is still down 0.8% year-to-date, but the recent increase indicates progress in challenging market conditions.

In March, trade value and volume increased, and the market diversified, with 2,245 distinct wine labels (LWIN11s) traded – the highest monthly total year-to-date.

Price changes within the index were evenly distributed among the 100 wines, with 47 increasing, 47 decreasing, and 6 remaining unchanged. Burgundy wines featured prominently among the top performers, with several increasing by over 5%. However, some Burgundy wines also experienced significant declines.

Californian wines continued their upward trend from February, with Napa Valley’s Harlan Estate 2018 and Dominus 2019 increasing by 11.4% and 4.7% respectively.

The top-performing wines within the Liv-ex 100 index in March were led by Domaine Jean Louis Chave Hermitage Rouge 2019 (up 16.6%) and Harlan Estate 2018 (up 11.4%). Burgundy’s Domaine Georges Roumier Bonnes Mares Grand Cru 2019 and Domaine Ponsot Clos de la Roche Grand Cru Cuvee Vielles Vignes 2019 increased by 10.1% and 7.6% respectively, followed by Masseto Toscana 2019, which grew by 7%.

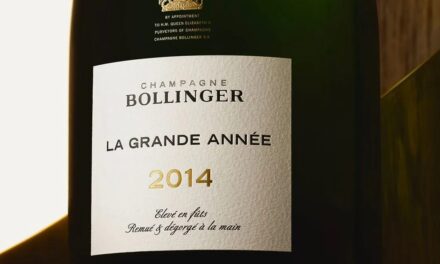

The Liv-ex Fine Wine 1000 index halted its four-month decline in March, staying flat. Most of its sub-indices also remained flat, with the Rhone 100 seeing the largest increase at 0.3%. The Champagne 50 was the worst performer, decreasing by 1.1%.

Trade sentiment for 2023 is mostly neutral or pessimistic, reflected in the indices’ performance. Nevertheless, the secondary market has begun to recover, with both trade value and volume increasing, and a diverse range of wine labels traded.

The Liv-ex Fine Wine 100 experienced a minor 0.2% rise in March, insufficient to offset the 1.85% loss since October 2022. The Champagne 50 has been falling for five consecutive months, with the worst performers being Salon Le Mesnil-sur-Oger Grand Cru 2006, Taittinger Comtes de Champagne Blanc de Blancs 2011, and Jacques Selosse Millesime 2008.

Some positives included champagnes from the 2012 vintage, such as Philipponnat Clos des Goisses 2012 and Pol Roger Sir Winston Churchill 2012, which both increased by 14.8% and 6.7% respectively.

The Liv-ex Fine Wine 1000 Index, the broadest measure of the market, comprises seven sub-indices from around the world, tracking price movements of 1,000 sought-after fine wines.