A 2023 Retrospective: Analyzing Trends, Challenges, and Prospects in an Era of Inflation, Geopolitical Tensions, and Shifting Investment Patterns

LONDON – A report by LIVEX provides a comprehensive overview of these complexities and their repercussions on various sectors.

Challenging Times for the Fine Wine Market Amidst Global Economic Uncertainty

The year 2023 has unfolded as a period of significant challenges, impacting not just the fine wine market but also broader financial markets and consumers worldwide.

Global Economic Slowdown and Inflationary Pressures

According to the International Monetary Fund (IMF), the global economy experienced a slowdown, with growth decelerating from 3.5% in 2022 to an estimated 3% in 2023. This slowdown is attributed to various factors, including the ongoing ramifications of the COVID-19 pandemic and the Russian invasion of Ukraine, which have significantly contributed to increases in energy and food prices. Additionally, the conflict between Israel and Palestine has exacerbated market insecurities, driving investors towards traditionally safe investments like gold. Notably, the inflation rates, while retreating from their peak in 2022, continue to be high, especially when excluding energy and food costs. The IMF anticipates that most countries will not achieve their inflation targets until 2025.

Regional Economic Variances

In the UK, there has been a notable reduction in the Consumer Prices Index (CPI), yet energy prices remain substantially higher compared to two years ago. This has led to a decrease in consumer spending on non-essentials. Contrasting this, the United States has shown more positive economic indicators, with a 4.9% rise in GDP in the third quarter and a lowering unemployment rate, suggesting a potential ‘soft landing’ scenario.

Emerging and developing economies are reportedly showing more resilience than their advanced counterparts, with the notable exception of China. The Chinese economy has been hindered by a struggling real estate sector and increasing personal debt, leading to Moody’s downgrading its credit outlook to negative.

Impact on the Fine Wine Market

The fine wine market in 2023 has experienced significant changes. Major Liv-ex indices, including the Liv-ex Fine Wine 100 and Fine Wine 50, have seen substantial declines. This downtrend contrasts sharply with the previous year’s performance, where fine wine had emerged as a stable investment compared to other financial assets.

The S&P 500 and gold markets have recovered, further impacting the comparative appeal of fine wine investments. Bordeaux wines have seen an increase in trade value, benefitting from their reputation as a safe investment choice during economic turmoil. However, regions like Burgundy have faced a decline in their market share.

2023 Trading Patterns and Outlook

Trading volumes on the Liv-ex exchange in 2023 slightly lagged behind the previous year, with a noticeable shift towards established brands and quality vintages. Bordeaux’s resurgence in trade value comes at a cost to other regions, with Burgundy being particularly affected. Italian wines, especially Piedmontese varieties, have shown resilience in the market.

Looking ahead to 2024, the fine wine market appears to be bracing for tougher times. With rising storage costs and a sense of overpricing by growers, many collectors have turned into net sellers. The wine market is caught in a typical bear market impasse, with sellers hesitant to lower prices and buyers reluctant to purchase at current market rates.

The Most-Traded Wines on Liv-ex in 2023

Dom Pérignon and Louis Roederer Lead the Charts

In the dynamic world of fine wine trading, 2023 saw some fascinating trends emerge on the Liv-ex exchange. Dominating the scene for most of the year was Dom Pérignon 2013, released at £1,830 per case of 12×75, marking it as both a collector’s choice and a valuable asset. However, in a late-year twist, Louis Roederer’s Cristal 2015 ousted Dom Pérignon from the top spot in terms of value. Priced at £2,068 per case, Cristal 2015 showcased the enduring allure and investment potential of top-tier Champagne.

Californian Wines Ascend the Ranks

The fine wine market, known for its traditional European strongholds, witnessed an interesting diversification in 2023. Californian wines, specifically Opus One 2019 and Screaming Eagle 2020, made a significant impact, ranking high in value traded. This shift not only highlights the broadening of the market but also underscores the global recognition and appreciation of wines from regions outside the traditional European vineyards.

Château Lafite and Pétrus: Icons of Quality

Further affirming the market’s preference for quality were the vintages from Château Lafite Rothschild (2010 and 2019) and Pétrus 2020, each scoring a perfect 100 points from Wine Advocate. These wines exemplify the “flight to quality” trend prevalent in the 2023 market, where investors and collectors gravitate towards wines with proven excellence and reputation.

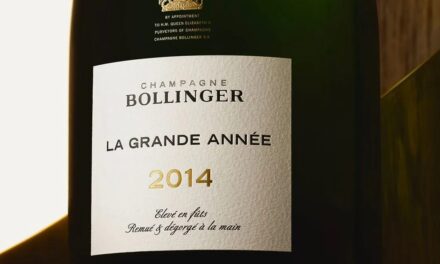

Champagne’s Dominance in Volume Trading

Champagne continued to dominate the volume trade, thanks to its dual appeal to both drinkers and collectors. Renowned names like Dom Pérignon, Cristal, and Taittinger Comtes de Champagne, along with Perrier Jouet Belle Epoque, featured prominently in the rankings, reflecting Champagne’s high liquidity and broad market appeal.

Bordeaux and the Rise of Accessible Investments

On the more accessible end of the spectrum, Bordeaux wines like Château Talbot 2020 offered an attractive investment opportunity. With a market price of £476 per case and a strong correlation between price and age, these wines represent a viable entry point for new investors looking to build a collection that appreciates over time.

Spotlight on Argiano’s Brunello di Montalcino

An interesting development in 2023 was the surge in trading of Argiano, Brunello di Montalcino 2018, following its recognition as Wine Spectator’s Wine of the Year. This accolade propelled the wine onto the most-traded list on Liv-ex, highlighting how critical acclaim can significantly influence market dynamics.

Conclusion

The year 2023 has been a testament to the fine wine market’s sensitivity to broader economic forces. The challenges faced globally have had a cascading effect on consumer spending, investment patterns, and ultimately, the dynamics of the fine wine market. The future of this market in 2024 and beyond remains contingent on the global economic landscape, with a potential for continued price pressures and cautious trading. This analysis by LIVEX underscores the intricate link between the fine wine market and the overall economic health of nations worldwide.

In conclusion, 2023’s trading activities on Liv-ex offered insightful glimpses into the evolving preferences and strategies of wine collectors and investors. From the dominance of renowned Champagnes to the rising prominence of Californian wines and the steady appeal of Bordeaux, the year was marked by both diversity and a discernible shift towards quality and provenance in the fine wine market.

Liv-ex analysis is drawn from the world’s most comprehensive database of fine wine prices. The data reflects the real time activity of Liv-ex’s 620+ merchant members from across the globe. Together they represent the largest pool of liquidity in the world – currently over £100m of bids and offers across 20,000 wines.